Изготовление уникальных металлических значков на заказ - это прекрасный способ добавить индивидуальность и стиль

Похмелье — это состояние, которое многие из нас испытывали после употребления алкоголя. Чувство недомогания,

Лампа-лупа является незаменимым помощником у целого ряда специалистов, например: косметологов, парикмахеров, массажистов и, конечно,

Накрутка жалоб в социальной сети ВКонтакте является одним из инструментов управления онлайн-репутацией и защиты

Переподготовка по психологии позволяет специалистам оставаться в курсе последних научных исследований, теорий и практических

В мире строительства каждый мастер понимает, что правильный выбор инструментов – залог успешного и

Флорариумы - это красивые миниатюрные сады, созданные в стеклянных контейнерах, где растения и элементы

При выборе квартиры в агентстве недвижимости, необходимо учитывать множество факторов, которые могут повлиять на

При необходимости пробить номер телефона часто прибегают к услугам профессионалов, таких как детективное агентство

Получить и использовать промокод Ашан достаточно просто. Необходимо выбрать подходящий промокод, ввести его в

Выбирая сумку на лето, подумайте о ее универсальности. Идеальная сумка должна хорошо сочетаться как

Лето – это пора свежести и ярких впечатлений. Важным элементом летнего образа является обувь.

Психологическая консультация – это важный инструмент, который помогает людям справляться с различными эмоциональными, психологическими

В современном мире смартфон является не просто устройством связи, а многофункциональным инструментом, который помогает

Мебель играет ключевую роль в создании атмосферы и комфорта в каждом доме. Она не

Свадьба – одно из самых ярких и значимых событий в жизни каждого человека. Этот

Особенно привлекательным направлением является Белек – райский уголок на юге страны, известный своими роскошными

Зимние букеты — это не только прекрасный способ добавить уюта и тепла в холодные

Пятигорск, расположенный в живописных предгорьях Кавказа, не только известен своими лечебными источниками, но и

Аренда зала фотостудии — важный шаг для профессиональных и любительских фотографов, стремящихся создать высококачественные

Реставрация изделий – это не просто процесс восстановления материальных ценностей, но и уважение к

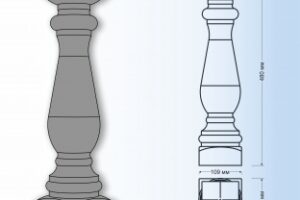

Создание деревянных балясин для лестницы собственными руками – это захватывающее и творческое предприятие, позволяющее

В эпоху цифровых технологий и онлайн-шопинга промокоды стали неотъемлемой частью розничной торговли и маркетинга.

Обращение в специализированный салон штор в Москве позволит получить профессиональную консультацию и помощь в

Покупка обуви в интернете становится всё более популярной из-за своей удобности и широкого ассортимента.

ЕГЭ (Единый государственный экзамен) – это важный этап в жизни каждого выпускника средней школы.

Сервис доставки "Макароллыч" – это отличное решение для тех, кто хочет наслаждаться вкусными суши

Рекламная акция с использованием купонов и промокодов может стать отличным способом привлечь новых клиентов